Windows 7 Product Key Download Free Download Full Version 64 Bit

One of Microsoft’s most successful and well-liked operating systems is Windows 7 Product Key. Despite the availability of Windows 11, many individuals are still using Windows 7. As alternatives to Windows 11, new and enhanced Windows versions, including Windows 10, Windows 8.1, and Windows 8, are just a handful.

Windows 7’s quickness and small weight are the major reasons to use it. Because Windows 7 Product Key Professional is the greatest business operating system available, it is still used by banks, businesses, companies, students, universities, offices, schools, and other organizations. This operating system is sophisticated yet safe.

Windows 7 Product Key Download For All Version

Windows 7 Free Download must be activated if you wish to use it to its full extent. You require an activation key or product key for that. It is available for purchase from Microsoft and other vendors. For those individuals who are unable to pay the activation key’s price, we have provided some product keys and activation keys that you can use on your PC. We have listed some alternative methods in case those keys don’t work.

Although the Windows 7 product key 2023 is a little more challenging to locate, it is fully functional. However, if you want to use it as the original, you should buy it. All Windows 7 product keys, including those for the Professional, Ultimate Home, and Starter editions, are available on our website.

Windows 7 Patch Download 64 Bit

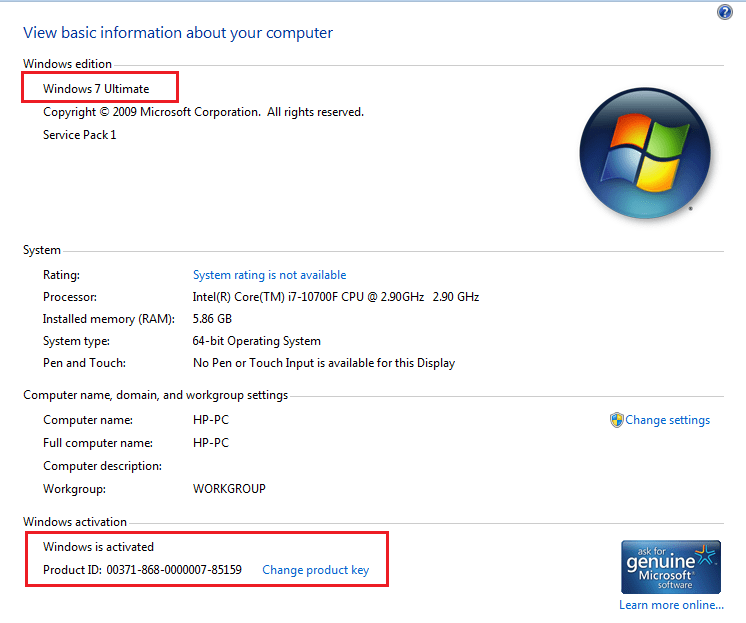

A product key is required for Windows 7 to function properly and be used as genuine. For Windows 7 activation, you can use the 25-character (XXXXX-XXXXX-XXXXX-XXXXX-XXXXX) activation code. Even if you bought Windows 7 at first, you still require this product code. Without an activation code, you cannot use the computer to operate it.

When you buy the operating system, you receive a series of numbers called the Windows 7 activation key. You may discover this product key once more if Windows 7 Product Key 32 Bit has already been installed on the PC. You can locate the Windows 7 product key that you purchased or saved for free in this manner.

Key Features of Windows 7:

- Better User Interface: Compared to Windows Vista, Windows 7’s user interface is more polished and developed. The “Superbar,” a new taskbar with clickable thumbnails, and improved window management were among its highlights.

- Performance Improvements: Compared to Windows Vista, Windows 7 Product Key Activation has faster boot times, smoother multitasking, and improved general responsiveness due to its focus on enhancing system performance and resource management.

- Libraries: To better organize and access files, libraries were introduced. To simplify handling files scattered across numerous discs and directories, they offered virtual folders that gathered content from various physical places.

- Jump Lists: Jump Lists offered easy access to recently used tasks, recently accessed documents, and even certain application-related actions. This feature improved taskbar usability and boosted user productivity.

- HomeGroup: On a local network, HomeGroup made it easier to share files, printers, and other resources. It made it simpler for consumers to set up secure sharing between Windows 7 computers.

- Networking Enhancements: Windows 7 offered networking enhancements, such as enhanced wireless networking compatibility, streamlined VPN setup, and the capacity to more efficiently handle many active network connections.

- Aero Peek and Aero Snap: When a user hovers over a certain region, Aero Peek turns open windows translucent, giving them a short overview of the desktop. Users could quickly arrange and resize windows by dragging them to the screen’s edges, thanks to Aero Snap.

- Enhanced Device Management: Windows 7 innovations like Device Stage, which offered a central area for viewing and controlling connected devices and their related activities, improved device management.

- DirectAccess: This function improved connectivity for remote workers by enabling seamless and secure remote access to corporate networks without the need for conventional VPN connections.

- BitLocker and BitLocker To Go: To secure data on local drives and portable storage devices, Windows 7 added better encryption capabilities with BitLocker.

- Windows XP Mode: Windows 7 Professional, Enterprise, and Ultimate editions contained Windows XP Mode, which allowed XP applications to operate inside a virtualized environment for customers who needed to run older programs.

- Improved Security: Windows 7 came with several security changes, including upgrades to User Account Control (UAC), improved firewall settings, and better system update management.

Main Features:

- Additionally, stability and security were heavily emphasized.

- It also includes all of Microsoft’s November upgrades.

- It is the most widely used type of Windows operating system worldwide.

- Windows Media Player 11, which is included, will considerably expand the media life.

- Internet Explorer 11 is included, offering the most recent improvements that considerably improve web browsing.

Windows 7 Product Key

TFDEY-WSHUV-NFOCR-FXUFI-XFWKH

WEILG-TUICFO-XDUUN-MRICD-XEVFC

RJIOT-FGYU-HJFRCD-XJKBGV-FCNXM

Windows 7 Serial Number

KTGFC-DXPIJB-GVNCF-MDXLA-YUHJIV

EFCDX-SNKBG-VFCDX-JIKTGR-FWDSU

IOBGVF-CDXN-MBVCJ-MKLH-YTGRF

Windows 7 License Key

CXJIO-EWSDA-TYGUHJ-GFVGC-HJNK

RGFVC-DUHJI-PKIMT-BHRGVF-CEJIKO

LIKUJ-HGJNI-VRFJC-XDSM-KORG

Windows 7 Patch Key

TFVCD-SGYUJ-IBKGV-FCNJ-IDW9SH

UJMRIK-TNBHB-GVRFC-DI6KO-GTRFI8

GCFDI-NFYEW-XIKFD-MFKU-XFKDCFU

System Requirements:

- Processor: 2.1 GHz

- Memory (RAM): 3 GB

- Graphics card: 345 MB

- Hard Disk Space: 78 GB

Some Frequently Questions

- Is Windows 7 only utilized by professionals when this activation is used?

It can be applied to various Windows 7 versions, not just one. The activator supports All operating system versions so that you won’t experience any issues. As a result, you can activate the operating system using a certain tool. You can examine the similarity if you are using another way.

- How secure is Windows 7 activation?

If you have a specific product key, activating Windows 7 is secure. However, complete each stage of the process as soon as possible. If you don’t take the measures, you could run into many problems.

- Does the activation key include any viruses?

You won’t contract any viruses because the technique is safe and virus-free. It is scanned in a way that excludes the possibility of any viruses. It would help if you turned off antivirus since a particular program has ostracised these directories.

- Is there a danger that the activation key might be fake?

No, you shouldn’t experience any problems if you purchased it from Microsoft. However, if you purchase it elsewhere, it can be a fake. When purchasing, make the appropriate choice. Take your time and make the right choice to save time and money.

- If the copied code fails, what will happen?

To ensure everything runs smoothly, copy the code from a specific extension. Although it needs to be altered and changed so the code can be copied easily, you can also use it in Notepad. Remember that this code is the most straightforward option, saving you time.

- Is Windows 7 activation required?

It’s not, yet it has many advantages and benefits. It can provide the newest features to enhance your operating system properly.

- What occurs if Windows 7 is not activated?

An “Activate Windows Online Now” notice will appear in the system tray if you don’t activate Windows 7 during installation. Also, Windows 7 won’t run any system updates after the grace time.

Conclusion

Windows 7 product keys have been essential in ensuring the operating system is real and legitimate. Although many people still have happy memories of Windows 7, users must consider the security and compatibility repercussions of using this obsolete operating system. Upgrading to a supported operating system is the best method to guarantee a safe and modern computing environment. However, if you decide to keep using Windows 7, protecting your computer and data should be your main concern.